Table of content

- Introduction

- What’s driving Indian women to invest in real estate?

- Why should a woman buy a home in her name in India?

- What are the Concessional Stamp Duty Rates for Women Across States?

- How do you register a property in your name?

- How do Women Benefit from Tax Deductions on Home Loans?

- Step by Step guide for home loan application

- Government Schemes Simplifying Homeownership for Underprivileged Women Home Buyers

- Highlights of the Union Budget 2024: Empowering Women and Girls

- Tips for Women Ready to Invest in Real Estate

- Conclusion

Introduction

In India, women are often seen as the home managers—the ones who truly keep everything together. A home just doesn’t feel right without them, does it? Yet, it’s surprising how many women don’t actually own their homes; they usually live in homes that are solely owned by their father or spouses.

But that’s changing! More and more women are now recognizing real estate as a powerful investment—whether it’s to secure their future in an era of rising costs or to finally own a space that’s truly theirs. No longer just caretakers of a home, they are becoming rightful owners, redefining what homeownership means on their own terms.

What’s driving Indian women to invest in real estate?

A recent survey in March 2024 by Anarock Property Consultants revealed a significant shift in investment preferences among Indian women. Over 60% are now choosing real estate over traditional investment options like gold. This trend is driven by several factors:

-

Financial Independence :

As women’s careers and incomes grow, they’re seeking investments that offer long-term security and stability.

-

Financial Security :

Real estate is a tangible investment, and in Indian society, it’s highly valued as a sign of financial stability. Owning a home represents the ultimate form of financial security.

-

Emotional Security :

Homeownership also provides a sense of financial and emotional stability, creating a safe haven for their immediate family.

-

Government Benefits :

Policies like reduced stamp duty rates and tax incentives encourage women to enter the real estate market.

These factors combined have led to a surge in women’s interest in real estate investment in India.

Why should a woman buy a home in her name in India?

Buying a home in a woman’s name in India comes with several advantages. Here’s why it’s a smart choice:

-

Lower Interest Rates on Home Loans :

Women can often secure lower interest rates on home loans, making financing easy and affordable saving a significant amount over the loan’s tenure.

-

Promotes Women’s Empowerment :

Encouraging property ownership in women’s names helps bridge the gender gap in real estate and contributes to women’s empowerment in society.

-

Tax Benefits :

Women property owners can enjoy tax benefits, including deductions on home loan interest and property taxes, which can offer long-term financial advantages.

-

Legal Protection :

When a property is registered in a woman’s name, it provides her with stronger legal rights over that property, often protecting her from future litigations.

-

Security for Women :

In metro cities, especially Bangalore, where rental prices are skyrocketing, owning a home offers women not only a safe and secure living space but also the potential for future income.

-

Lower Stamp Duty & Registration Charges :

Many states offer reduced stamp duty and registration fees for women buyers, which can lead to substantial savings compared to properties registered in a man’s name.

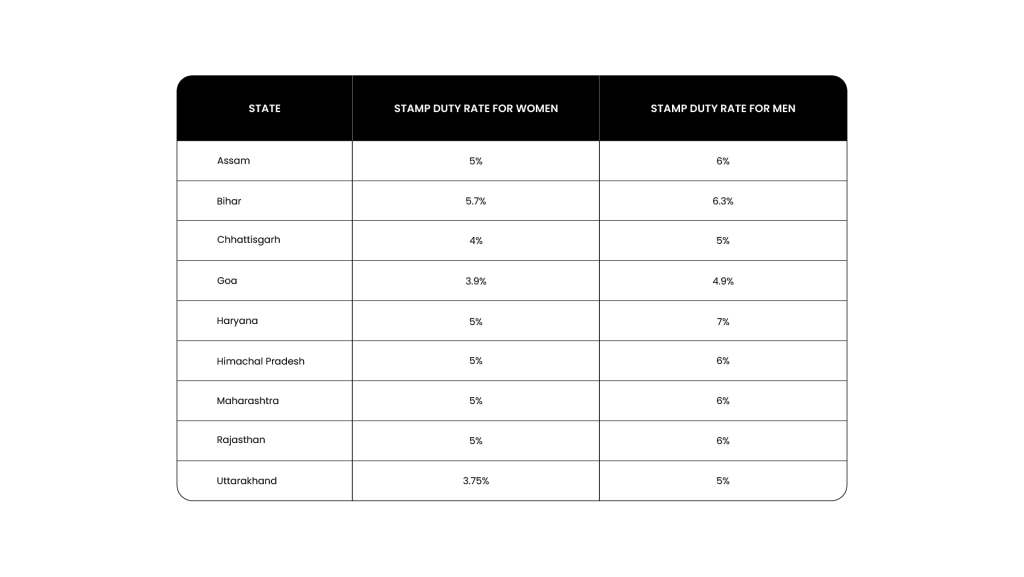

What are the Concessional Stamp Duty Rates for Women Across States?

Several states in India are already offering concessional stamp duty rates to encourage female property ownership. Here’s a look at some of the states that have implemented these measures:

How do you register a property in your name?

If you have read our blog, we are sure that you are excited about your own home. Here’s a simple guide to help you through the process:

-

1. Gather Your Essential Documents :

-

You’ll need some identity proof—like your Aadhaar card, PAN card, or passport.

-

Make sure you have proof of address, too. Things like voter ID or utility bills (electric bills, Gas bills) work great.

-

Don’t forget the property-related documents, including the sale deed and any agreements.

-

If you’re dealing with a builder or seller, obtain a No Objection Certificate (NOC) from them.

-

You’ll also want to collect property tax receipts and proof of payment for the stamp duty and registration fees.

-

-

2. Do a Thorough Check :

-

It’s super important to verify the property’s ownership and legal status. This will help you avoid any complications down the line.

-

-

3. Get Some Legal Help :

-

Consulting a lawyer can be really helpful. They can explain the legal aspects and make sure everything goes smoothly.

-

-

4. Make the Payment :

-

You’ll need to pay the necessary stamp duty and registration fees, so keep that in mind.

-

-

5. Evaluate the Property :

-

It’s a good idea to get a property valuation report for tax purposes.

-

-

6. Submit Your Documents :

-

Take all the necessary documents to the Sub-Registrar’s office.

-

-

7. Complete the Registration Process :

-

After everything is verified, your property will be registered in your name!

-

-

8. Collect Your Registered Deed :

-

Don’t forget to pick up the registered property deed from the Sub-Registrar’s office for your records.

-

How do Women Benefit from Tax Deductions on Home Loans?

Women in India are increasingly taking the lead in real estate investments, enjoying unique benefits when applying for home loans. In 2020 alone, women accounted for 11% of all home loan borrowers, demonstrating a significant increase from previous years.

Top Benefits of Women Taking Home Loans:

-

Lower Interest Rates :

Many financial institutions offer better rates to women homebuyers because they tend to have a good track record of repaying loans.

-

Higher Loan-to-Value (LTV) Ratios :

Women homebuyers often qualify for higher LTV ratios, meaning they may receive a larger loan amount relative to the property’s value. This can make it easier to purchase their dream home. However, it’s important to remember that a higher LTV ratio may increase the interest rate and extend the loan tenure, depending on the lender’s policies and risk assessment.

-

Reduced Processing Fees :

Streamlined processes and lower fees can save women significant costs.

-

Increased Loan Amounts and Extended Repayment Terms :

One notable benefit of housing loans for women is their potential access to larger loan amounts and longer repayment periods. Lenders are keen to attract female borrowers by offering higher home loans, with repayment terms extending up to 25 years. These enhanced benefits, along with more flexible eligibility criteria, present significant advantages for women seeking to invest in real estate.

-

Interest Deduction on Home Loans :

Women can claim significant tax savings on the interest paid for home loans. Under Section 24(b) of the Income Tax Act, 1961, a deduction of up to ₹2 lakh is available for self-occupied properties. For non-self-occupied properties, there’s no cap on the interest deduction.

-

Principal Repayment Deduction :

Under Section 80C of the Income Tax Act, women can claim tax deductions not only on the interest paid on home loans but also on the principal repayment. This provision allows for a maximum deduction limit of ₹1.5 lakh per financial year.

-

Joint Loan Benefits :

Tax benefits increase when women apply for home loans jointly with their spouses or close relatives. However, both must be co-owners of the property to qualify. So, it’s not just women who can benefit from this arrangement; men can also take advantage of the joint loan benefit. By having their spouse as a co-owner, couples can enjoy greater financial advantages, making homeownership more affordable and manageable.

-

Under-Construction Property Deductions :

For properties still under construction, the tax deductions start once possession is taken. The interest paid during construction can be claimed in five equal instalments, starting from the year of completion.

Step by Step guide for home loan application

-

Step 1: Loan Application :

- Fill out the home loan application form.

-

Step 2: Document Submission :

-

Provide all the necessary documents such as:

- – Identity and address proof.

- – Bank statements for the last 6 months.

- – Salary slips (for salaried individuals) or income tax returns (for self-employed individuals).

- – Property documents.

-

-

Step 3: Processing Fee Payment :

-

Pay the processing fee to the bank or financial institution. This fee covers administrative and processing costs.

-

-

Step 4: Document Verification :

-

The bank verifies all submitted documents to ensure authenticity. This includes checking credit history, income stability, and property details.

-

-

Step 5: Property Valuation and Legal Check :

-

The bank conducts a legal and technical check on the property to ensure there are no disputes and that the property is worth the loan amount.

-

-

Step 6: Sanction Letter Issuance :

-

Once verification is complete, the bank issues a sanction letter stating the loan amount, interest rate, tenure, and other terms and conditions.

-

-

Step 7: Loan Agreement Signing :

-

After successful verification and property assessment, you’ll sign the loan agreement, agreeing to the bank’s terms and conditions.

-

-

Step 8: Loan Disbursement :

-

-

Once the agreement is signed, the bank disburses the loan amount either in full or in installments, depending on the property construction status.

-

-

Government Schemes Simplifying Homeownership for Underprivileged Women Home Buyers

-

PMAY Benefits for Female Home Buyers in India :

The Pradhan Mantri Awas Yojana (PMAY) is a government initiative launched on June 25, 2015, aimed at providing affordable housing for the urban poor. It falls under the “Housing for All” program and focuses on reducing the housing shortage among economically weaker sections (EWS), low-income groups (LIG), and middle-income groups (MIG), as well as those living in slums.

-

Benefits for Women Under PMAY :

Female homebuyers enjoy several exclusive benefits under PMAY, making it easier for them to own their first home. Key advantages include:

-

Low-Interest Rates

-

Subsidy on Home Loans

-

Reduced Stamp Duty

-

Tax Benefits

-

No Prepayment Charges

-

Highlights of the Union Budget 2024: Empowering Women and Girls

Relief for Women Homebuyers

In the Union Budget 2024, the Finance Minister introduced measures to lighten the financial load for women homebuyers. One key initiative encourages states to reduce high stamp duty rates, with additional reductions for properties purchased by women. This reform forms a vital part of the urban development strategy, making homeownership more accessible for women.

Tips for Women Ready to Invest in Real Estate

Ready to take that exciting step into homeownership? Owning a home is one of the most empowering ways to secure your financial future. With a few smart strategies, you can make the most of the benefits available to women homebuyers in India. Here’s your guide to finding—and securing—the perfect home:

-

Know Your Budget & Financing Options :

Start by defining how much you’re comfortable spending without compromising other financial priorities. When exploring home loans, compare different lenders for the best rates—many offer special rates for women borrowers.

-

Choose the Right Location :

Whether it’s close to work, near good schools, or in a neighbourhood with great amenities, pick a spot that suits your lifestyle. And think long-term—locations with growth potential often lead to better returns down the line.

-

Consider Pre-Launch Properties :

Looking to bag a great deal and unique perks? Pre-launch properties are a fantastic option. These are projects that haven’t officially hit the market yet, so developers often offer lower prices and attractive incentives to early buyers. Not only could you save a good amount upfront, but by getting in early, you’ll also have a better chance to secure the best units, which tend to sell out quickly. Just remember to do your due diligence—checking the builder’s reputation and reviewing project approvals—to make sure it’s a solid investment.

-

Understand Your Tax Benefits :

Women homebuyers can take advantage of deductions on home loan interest and principal repayment. If you’re a first-time buyer, these tax breaks can really add up, helping you save in the long run.

-

Check the Legal Details :

Before you buy, make sure the property has clear legal titles and approvals. A quick consultation with a legal expert can help you sail through the registration and paperwork without surprises.

-

Prioritise Safety & Amenities :

Look for gated communities or societies with round-the-clock security for extra peace of mind. And amenities like a gym, pool, and parks can enhance your quality of life—and boost future resale value.

-

Plan for the Long Haul :

Try to choose a property that can evolve with you. Whether it’s future family plans, work-from-home needs, or lifestyle changes, a flexible space will stay relevant as life unfolds.

Conclusion

Women, don’t hold back from pursuing your dream home! The landscape for women homebuyers in India is changing for the better. You are not just financially empowered; you’re part of a growing movement that celebrates women’s roles in real estate.

You can take advantage of lower home loan interest rates and attractive income tax deductions, lower stamp duty making your journey toward homeownership even more achievable. These initiatives aren’t just about acquiring property—they’re about empowering you to take control of your financial future and helping you build a secure and fulfilling life.

P.S. You go, girl! So proud of you!

Ready to turn your dream home into reality? Modern Spaaces is here to guide you every step of the way! We offer comprehensive support, from finding your perfect forever home to financial consultancy and expert real estate advice.

Visit our website at www.modernspaaces.com or call us at 99000 99324

Read our Latest Blogs

Rise of Women homeowners: Why are they turning towards real estate?

Author: Vinay Gurudutt

- May 13, 2025

- 19 min read

Spotlight on Modern Spaaces

Author: Vinay Gurudutt

- May 13, 2025

- 4 min read

Build Your Dream Home: The Benefits of Plotted Developments

Author: Vinay Gurudutt

- May 13, 2025

- 11 min read

Explore Projects

The True 3 BHK

starts @ 1.55 Cr

Multi-Gen 2 & 3 BHK Homes

Starts @ 1.4 Cr

Pristine Villa Plots

starts @ 1.15 Cr

Refer & Earn Up to 2%

Invite your friends to explore Modern Spaaces and earn up to 5% of the home value they buy.

Find your Dream Home. Let's talk

Tell us a bit about what you're looking for. One of us will get back to you!