Table of Contents

- Introduction

- What is Khata?

- How did A Khata and B Khata come into existence?

- What is Khata Extract?

- How is Khata different from Title Deed?

- Why is Khata important for Property Investors and Buyers?

- Contents of the Khata

- Types of Khata

- List of properties listed by BBMP Covered Under B Khata

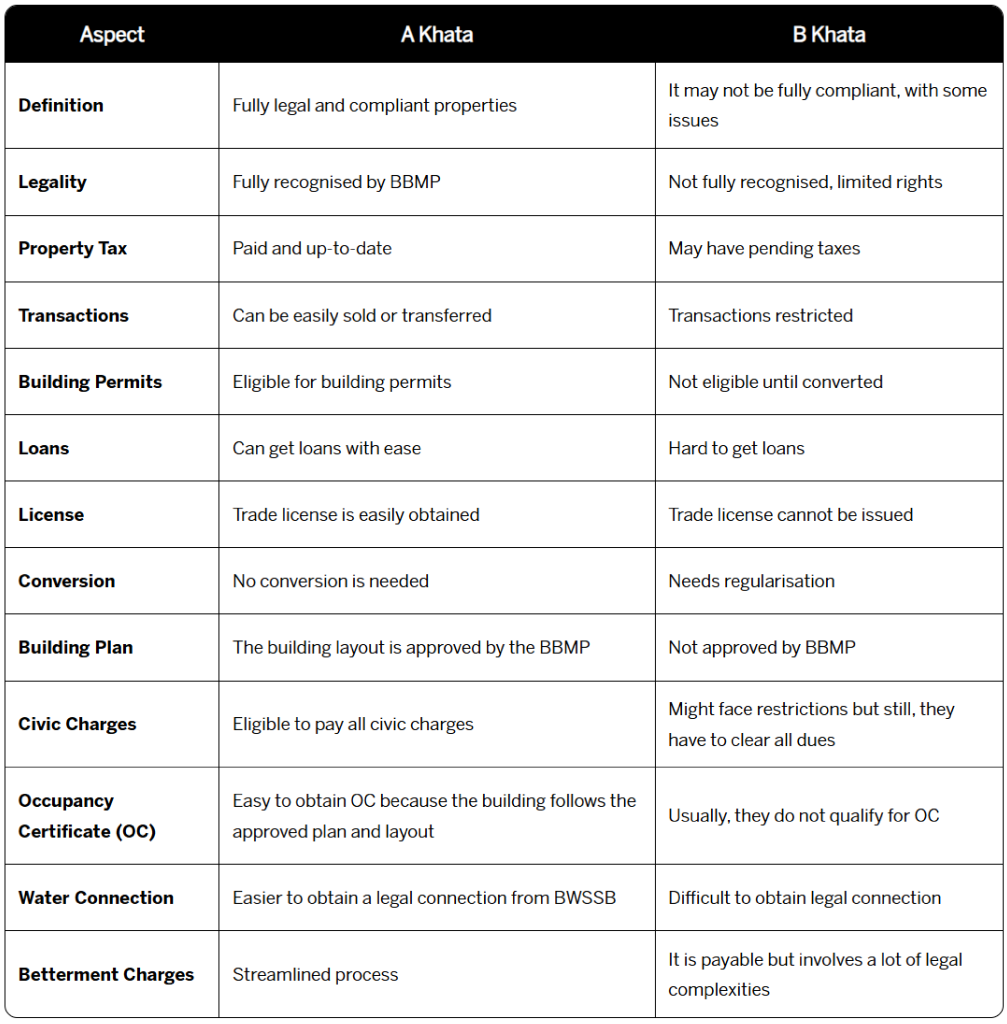

- <Difference between A Khata and B Khata

- Is it possible to get a loan on B khata property?

- Panchayat Khata(E- Khata)

- Is it possible to convert B Khata into A Khata?

- When is Khata Transfer Required?

- How long does it take to complete a Khata transfer?

- The Importance of the following departments in Khata transaction:

- How to do Khata transfer in Bangalore?

- Khata transfer charges in Bangalore

- Why is having a Khata essential?

- Conclusion

Introduction

Are you still searching for your dream home, or have you already found the perfect property? Before you take the next step, it’s crucial to understand a few key technical terms related to Bangalore real estate, especially the Khata system. Many property buyers find themselves overwhelmed by the legal jargon and complexities. To ensure a smooth and informed buying experience, it’s important to familiarise yourself with these terms. Trust me, once you read the blog, you’ll realise it’s simpler than it seems. Go ahead and read the blog to become an informed homeowner.

What is Khata?

The word “Khata” literally means account and holds significant importance in property transactions. It is a crucial legal document that functions as an official record, that recognises and certifies specific properties in the city. This simplifies processes like:

-

Tax payments

-

Licensing

-

Obtaining loans

-

Property approvals

-

Official procedures

How did A Khata and B Khata come into existence?

The concept came into importance in 2007 with the establishment of the BBMP (Bruhat Bengaluru Mahanagara Palike), the municipal corporation of Bangalore. This move was aimed at introducing a standardised tax assessment across the city.

What is Khata Extract?

It is an official document issued by the Bruhat Bengaluru Mahanagara Palike (BBMP) that provides detailed information about a property. This extract includes essential details such as:

-

Property taxes due

-

Size of the property

-

Location of the property

-

Built-up area of the property

-

Purpose of utilisation

-

Annual value

While a Khata document establishes the owner’s identity and rights, a Khata Extract provides comprehensive details about the property. Both documents are issued together by the BBMP and serve complementary purposes in property ownership, transactions, and taxation.

How is Khata different from Title Deed?

Many people mistakenly believe that both documents are the same. In reality, a Title Deed is a written document between the buyer and the seller during a property transfer and proves ownership of the property. On the other hand, aKhata certificate is primarily used for property tax purposes and maintaining official records. It verifies the property’s existence and helps assess the applicable tax amount.

Why is Khata important for Property Investors and Buyers?

-

Confidence in Ownership :

It verifies the property’s legitimacy, giving you peace of mind that you are investing in legal property.

-

Informed Decisions :

A comprehensive record of the property, including its details and any relevant history.

-

Simplified Transactions :

Essential for securing property tax documents and ensuring you can pay taxes smoothly. This avoids future complications.

-

Access to Utilities :

Obtaining water and electricity connections for your property becomes easier.

-

Loan Eligibility :

A Khata makes it easy to secure loans from banks and housing finance institutions for your property purchase.

Contents of the Khata

They contain vital information like owner name, size, location, built-up area, and official identification details like the property number, and extent of the property. This information is essential for the authorities to accurately assess your property tax.

Types of Khata

-

A Khata :

This signifies that the property is as per the norms stipulated by the statutory authorities and permanent property records. It has a clear title and means that property taxes are cleared, making it easier to handle financial transactions, apply for licenses, and seek loans.

-

B Khata :

This is a temporary document issued for properties that are considered semi-legal or in violation of building bylaws and regulations.

List of properties listed by BBMP Covered Under B Khata

The Bruhat Bengaluru Mahanagara Palike (BBMP) includes properties that match any of the following shortcomings:

-

1. In violation of specific bylaws :

Properties constructed without adhering to the approved building plans or violating zoning regulations are categorised under it.

-

2. Constructed upon revenue land :

Properties built on revenue land without proper permissions are considered illegal.

-

3. Constructed in unauthorised layouts :

Properties built-in layouts that are not approved by the authorities.

-

4. Properties without completion or issuance certificates :

Properties that do not have the necessary completion or issuance certificates are considered illegal and are listed under B Khata.

Difference between A Khata and B Khata

Is it possible to get a loan on B khata property?

Yes, it is possible to get a loan against B Khata properties, but it can be difficult due to legal issues linked to unauthorised construction. Most national banks typically do not offer loans for B Khata properties. However, some private banks may provide loans, but the interest rates are generally higher.

Panchayat Khata(E- Khata)

It is an official document issued by the Gram Panchayat, similar to the one issued by the Bruhat Bengaluru Mahanagara Palike (BBMP). It applies to properties within urban areas falling under Gram Panchayat jurisdiction, even if those villages are located within the broader Bangalore district.

For example: While a major part of Marathahalli falls under BBMP limits some pockets on the outskirts, especially towards the north and east, might still be under Gram Panchayat control and have Panchayat Khata. This is because Bangalore’s urban sprawl is constantly expanding, and some villages are gradually being integrated into the city limits.

Is it possible to convert B Khata into A Khata?

Yes, it is possible, but before a conversion application can be filed one has to clear all the prescribed tax dues, penalties, property taxes, DC conversion charges, and the betterment charges levied by the relevant authorities.

When is Khata Transfer Required?

Transfer is mandatory whenever ownership of a property changes hands. This can happen due to:

-

Sale

-

Gift

-

Will

-

Death of the owner

To initiate the process, you have to submit a requisition letter along with the following documents: the title deed, tax payment receipts, details, national savings certificate, death certificate (if applicable), and an affidavit declaring the legal heirs.

How long does it take to complete a Khata transfer?

Expect the transfer process to be completed within 30 to 45 days, depending on various factors like

-

Document Accuracy :

All submitted documents must be complete and accurate to avoid delays in processing or revisions.

-

BBMP Inspection :

The Bangalore Municipal Corporation (BBMP) may conduct a property inspection, which can impact the timeline.

-

Incomplete Documents :

Missing or incorrect documents will require resubmission, causing delays.

-

Bureaucratic Delays :

The transfer process can sometimes be frustratingly slow due to bureaucratic hurdles. The transfer process relies on the interconnected work of the BBMP, Sub-Registrar, and Revenue Department. This interdependence can cause delays if any department faces an increased workload or any other issue.

The Importance of the following departments in Khata transaction:

-

BBMP (Bruhat Bengaluru Mahanagara Palike) :

Maintaining and updating property records, assessing property taxes, and issuing

-

Sub-Registrar :

The Sub-Registrar acts as a legal custodian, ensuring proper documentation and adherence to legal regulations during property transactions by registering the sale or transfer of property rights.

-

Revenue Department :

The Revenue Department plays a vital role in verifying the complete payment of property taxes before approving the transfer of Khata certificates.

How to do Khata transfer in Bangalore?

Online Transfer via Sakala Portal:

-

Step 1 :

Visit the official Sakala website(https://sakala.kar.nic.in/).

-

Step 2 :

Select “Khata Transfer” and download the online application form.

-

Step 3 :

Enter your name as it appears on your Aadhaar card, property details (type, measurements, status), and contact information (mobile number and email address) as per the Sale Deed.

-

Step 4 :

Attach all necessary documents and submit the completed application form online.

-

Step 5 :

BBMP will Assess the property and notify you of the charges.

-

Step 6 :

Collect it from the BBMP office.

Khata transfer charges in Bangalore

The registration fee is typically calculated as 2% of the property’s value stated in the sale deed.

Let’s say you have a property with a sale deed that states its value as Rs. 50,00,000 (50 lakhs). To calculate the transfer fee, you would take 2% of this value:

2% of Rs. 50,00,000 = 0.02 * 50,00,000 = Rs. 1,00,000

So, the transfer fee for this property would be Rs. 1,00,000.

Why is having a Khata essential?

To sum it up it is one of the important documents that a homeowner must possess to verify ownership of the property and enjoy the benefits associated with it.

-

Provides complete information about the property, such as type, size, location, area, flat or house number, number of floors, and establishment date.

-

Assists property owners in obtaining trade licenses and loans.

-

Simplifies the process of filing and paying property taxes.

-

Helps in securing electricity and water connections for the property.

Conclusion

Each state in India has its own requirements for property documents. By understanding the legal status of a property, you can make a better decision when buying your home. Choosing a property with complete documentation ensures a smoother ownership experience and helps avoid future financial issues.

Read our Latest Blogs

Rise of Women homeowners: Why are they turning towards real estate?

Author: Vinay Gurudutt

- May 13, 2025

- 19 min read

Spotlight on Modern Spaaces

Author: Vinay Gurudutt

- May 13, 2025

- 4 min read

Build Your Dream Home: The Benefits of Plotted Developments

Author: Vinay Gurudutt

- May 13, 2025

- 11 min read

Explore Projects

The True 3 BHK

starts @ 1.55 Cr

Multi-Gen 2 & 3 BHK Homes

Starts @ 1.4 Cr

Pristine Villa Plots

starts @ 1.15 Cr

Refer & Earn Up to 2%

Invite your friends to explore Modern Spaaces and earn up to 5% of the home value they buy.

Find your Dream Home. Let's talk

Tell us a bit about what you're looking for. One of us will get back to you!