Table of Contents

- Introduction

- What’s fueling this growth?

- Indian Real Estate Market Overview

- Key Trends Shaping Indian Real Estate

- The Rise of Multigenerational Living

- Sustainable and Green Buildings on the Rise

- India’s Senior Living Market

- Evolving Technology

- Co-Living Spaces

- What is driving the demand for Co-Living Space?

- Up and Coming Tier II cities

- International Investment Trends

- Luxury & High-End Housing

- Market Growth and Price Trends in Bangalore

- Conclusion

Introduction

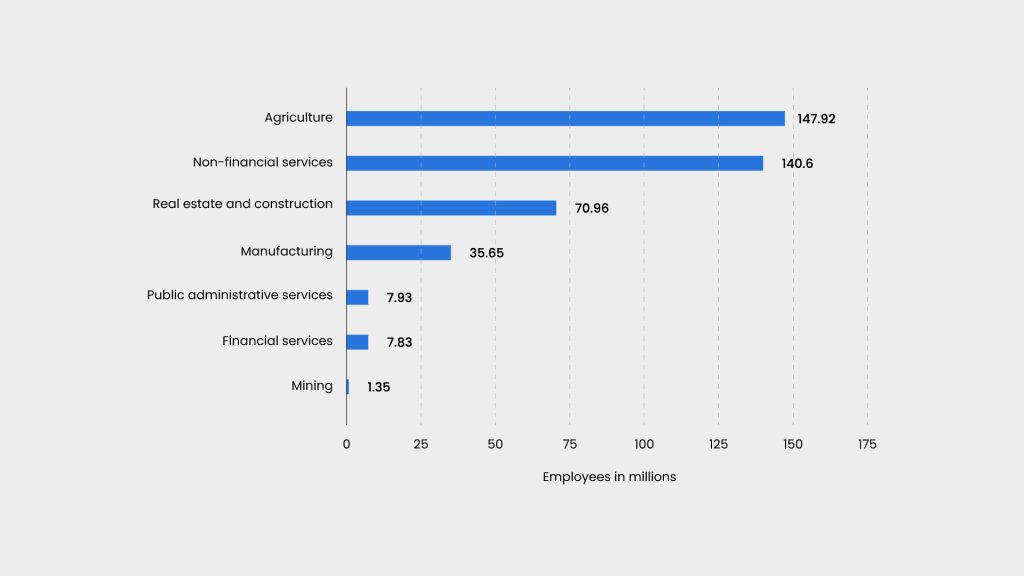

The Indian real estate market is riding a wave of transformation, making it one of the most dynamic sectors in the country. As the third-largest job provider after agriculture and non-financial services, real estate is setting up for exponential growth, with projections estimating its value at a whopping $6 trillion by 2047 (approximately 498 lakh crore INR). In 2025, the industry is on track for significant developments in residential, commercial, and rental markets, all driven by urbanisation, tech integration, and evolving lifestyle trends. Join us as we unpack the trends and factors shaping Indian real estate in 2025.

What’s fueling this growth?

It’s the surge in urbanisation, rising incomes, and the growing need for everything from homes and offices to logistics hubs and data centres. Experts are forecasting robust growth in residential, commercial, and rental segments, projecting the industry to hit an incredible USD 5.8 trillion ( approximately 481.4 trillion INR) by 2047. With new opportunities on the horizon, the future of real estate in India looks brighter than ever, promising dynamic changes and steady progress across the sector!

Indian Real Estate Market Overview

Economic Growth: The overall real estate market is anticipated to expand significantly by 2025, with luxury housing sales showing remarkable growth in 2024, indicating sustained demand.

Market Size: The total value of the Indian real estate market in 2025 is estimated to be around $300 billion, which is approximately ₹24 lakh crore (Indian Rupees).

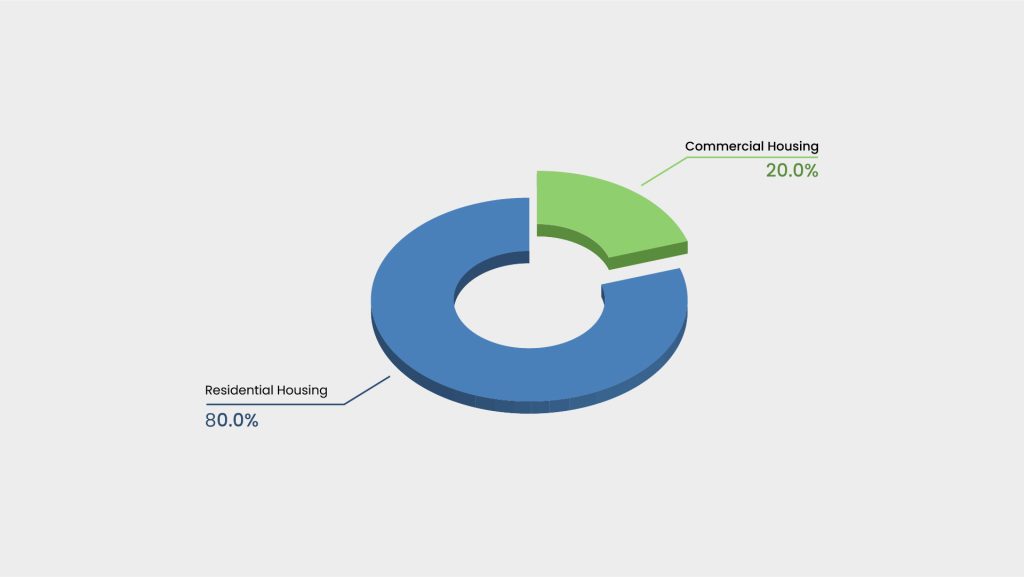

Residential vs. Commercial:

-

Residential :

This segment accounts for 80% of the total market size. It includes houses, apartments, and other residential properties.

-

Commercial :

This segment makes up 20% of the market and includes offices, retail spaces, and industrial properties.

-

Housing Shortfall :

There is a current shortfall of 1.8 crore (18 million) housing units and this shortage is expected to rise to 7 crore (70 million) units by 2030.

Key Trends Shaping Indian Real Estate

The Rise of Multigenerational Living

Although Indians have lived in traditional joint families for centuries, the newer generations are discovering fresh interest in this way of life. This has resulted in the new trend of multigenerational living gaining momentum in India, and it’s expected to grow even stronger in 2025. With rising costs, many families are choosing to live together, benefiting from shared utility bills, the ability to care for ageing parents, and support in child-rearing. This shift is driving the demand for homes that accommodate the diverse needs of all family members, from toddlers to grandparents. Jogging tracks and a variety of other sports facilities, along with clubhouses and recreational centres set within green spaces, have become essential. These features are necessary to cater to the diverse needs of all community members.

At Modern Spaaces, we’re excited to meet this demand with thoughtfully designed homes that offer both privacy and space for family connection. Our homes feature spacious bedrooms for personal comfort, as well as communal areas with age-appropriate amenities that encourage interaction and togetherness.

Abhilash Cannoth, our VP of Sales, shares, “At Serene Heights, we aim to create inclusive spaces that seamlessly blend comfort and connection. These thoughtfully designed multigenerational homes cater to the needs of every family member, ensuring a harmonious living experience.”

Sustainable and Green Buildings on the Rise

Sustainability in the last few years has gained the right kind of attention it deserves and as we head into 2025, the focus on green, energy-efficient buildings is only growing. Homebuyers are increasingly drawn to eco-friendly designs and energy-saving features, and developers are stepping up to meet the demand with sustainable materials and construction methods.

At Modern Spaaces, we’re fully embracing the green revolution. Our projects showcase sustainable features like solar panels, rainwater harvesting, open spaces, and native trees—connecting residents with nature and boosting energy efficiency. We’re committed to building homes that are sustainable, energy-efficient, and environmentally responsible because we believe a greener home leads to a brighter future for everyone.

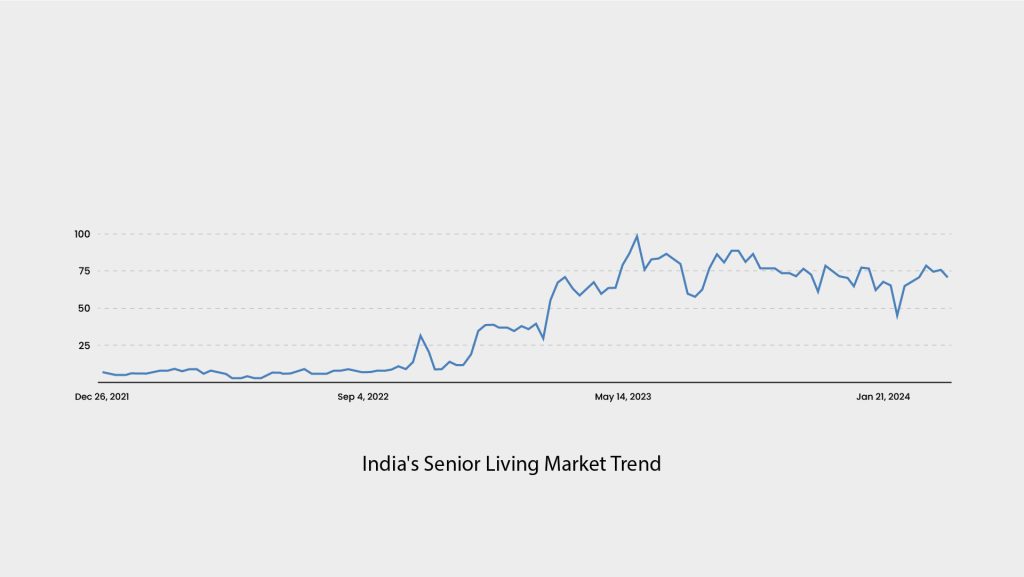

India’s Senior Living Market

India’s senior living market is set to expand rapidly, currently valued at approximately ₹1.66–₹2.49 lakh crore, and is expected to grow significantly to ₹9.96 lakh crore by 2030. Colliers. This growth is driven by a rising ageing population, which is expected to make up 21% of India’s total population by 2050 and is supported by changing family dynamics like children settling abroad or moving to different cities within India and greater financial independence among seniors, especially in urban areas.

Programs like the Atal Vayo Abhyuday Yojana (AVYAY) provide funding for Senior Citizen Homes, aiming to improve the quality of life for seniors. Added benefits, such as tax incentives, reduced development charges, and flexible zoning, will encourage more senior living projects.

Evolving Technology

Emerging technologies are transforming the real estate industry, offering significant advantages to the real estate sector. While these innovations are still in their early stages, we can expect them to make a big splash in the coming year and beyond. These advancements are set to completely change the way real estate works, making everything faster, smarter, and more efficient. It’s an exciting time for the sector, with lots of potential for transformation!

-

AI and predictive analytics :

AI is really changing the game in real estate. With predictive analytics, it helps investors and developers get ahead of the curve by analysing market trends and property values.

-

Virtual and augmented reality :

Virtual reality (VR) and augmented reality (AR) will be making property tours more fun and convenient. VR allows buyers to take a full tour of a property without ever leaving their home, saving time and effort. With AR, you can see how a property would look with your personal touch—whether it’s adding furniture, changing the decor, or even planning a renovation—before you even make a decision. It’s all about helping you visualise the possibilities.

-

IoT integration :

The Internet of Things (IoT) is bringing smart homes into the real estate spotlight. From smart water meters to security systems that you can control remotely, IoT devices are making life easier and more energy-efficient.

-

Fintech solutions :

Fintech, the fusion of technology with financial services, has experienced rapid growth in India, positioning the country as one of the fastest- growing fintech markets globally.With the second – largest internet user base, India has quickly embraced financial technology.Key segments that impact this growth include digital lending, digital payments, wealth tech, and blockchain.

According to leading research reports, the FinTech industry in India was valued at Rs 1,920 billion in 2019 and is expected to reach Rs 6,207 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of approximately 22% during the 2020-2025 period.

In real estate transactions, fintech is streamlining the entire process. Online payment systems simplify buying, selling, and renting properties. Collectively, these innovations drive growth, improve customer experience, and create a more dynamic real estate market, benefiting stakeholders across both industries.

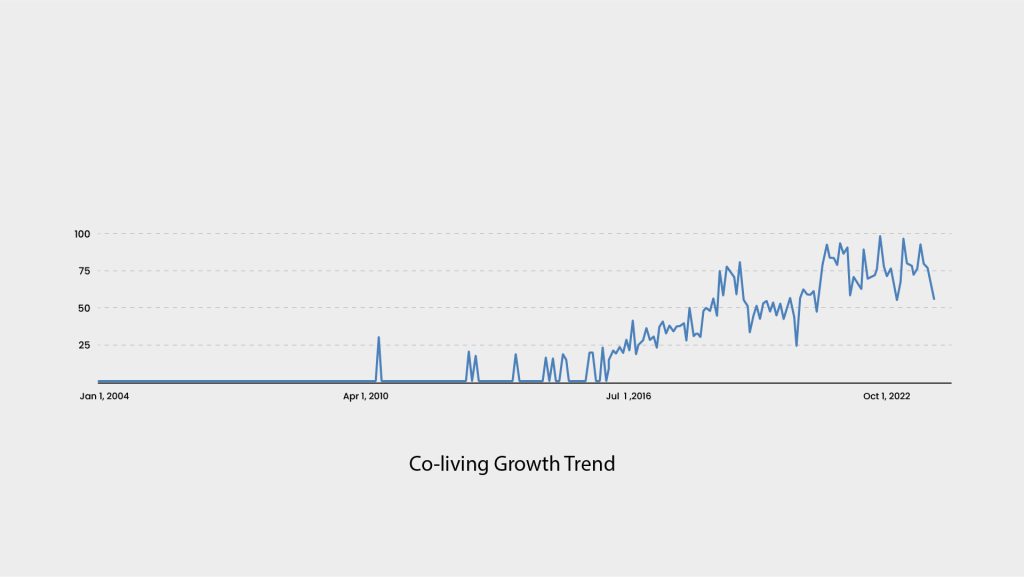

Co-Living Spaces

The co-living market in India is set for significant growth, with projections indicating a compound annual growth rate (CAGR) of 17% from 2020 to 2025. This growth is expected to elevate the market’s value to approximately USD 40 billion (3,509.6 billion INR) by 2025, this trend is driven primarily by urbanisation and the evolving lifestyle preferences of millennials and Gen Z.

What is driving the demand for Co-Living Space?

-

Affordability :

As property prices and rental rates climb, traditional housing options are increasingly out of reach. Co-living offers a budget-friendly solution, where individuals can split costs for rent, utilities, and shared amenities.

-

Convenience and Flexibility :

Co-living spaces are designed for ease, with fully furnished rooms and shared facilities like kitchens, workspaces, and recreational areas. Flexible leases ( short duration like a few months) further simplify moving in or adjusting living arrangements.

-

Social Connection and Community :

Co-living encourages community and social engagement, allowing residents to connect with like-minded individuals, build networks, and find support in a new city.

Up and Coming Tier II cities

India’s real estate sector is witnessing a dynamic transformation, as Tier 2 cities rise as new centres of development and investment. Traditionally, Tier 1 cities like Mumbai, Bangalore, and Delhi-NCR have led the market with the majority of investments, but recent trends reveal a growing shift toward smaller cities. This shift is fueled by a unique combination of affordability, strong growth potential, and government initiatives.

Affordability is a major draw for both buyers and developers in Tier 2 cities, offering a more accessible alternative to the high prices of Tier 1 cities. Reflecting this trend, housing sales in Tier 2 cities increased by 11% in the last fiscal year , with nearly 208,000 units sold across 30 towns—signifying the sector’s expanding reach into these emerging regions.

International Investment Trends

India’s real estate market is thriving, with global investors showing significant interest, especially in luxury housing and cutting-edge infrastructure like data centres. This surge is driven by the rising affluence of India’s middle and upper classes, which drives the demand for high-end properties in cities. With changing demographics and evolving aspirations, local investment strategies are adapting to align with global trends, opening up exciting opportunities for investors looking to tap into India’s expanding property market.

Foreign capital is taking up a major portion of investment in real estate—international investments made up about 81% of total investments in Indian real estate between 2017 and 2022.

-

Strong demand for Grade A office space :

India’s major cities are seeing a surge in demand for top-tier office space as multinational brands and prominent Indian corporations establish headquarters in prime business districts. This trend is fuelled by growing investor confidence, spurred by India’s marked improvement in the ease of doing business rankings.

-

Relaxation of FDI policy :

While 100% foreign direct investment in townships, housing, and infrastructure has been allowed since 2005, the Government of India relaxed regulations in 2014, reducing minimum built-up area and capital requirements and making exit norms more flexible for foreign investors in the construction sector.

-

Growth in the ‘prop-tech’ space :

The industrial and logistics segment is seeing rapid momentum, largely driven by demand for warehousing from e-commerce and third-party logistics (3PL) firms. This trend saw industrial and logistics assets attracting nearly a third of foreign investments (USD 1.1 billion) in the real estate sector in 2021.

-

Investment options like REITs :

Real Estate Investment Trusts (REITs) are an appealing option for foreign investors, they offer low-risk investment, with strong capital appreciation potential, regular income, and easy exit options, but REITs in India must be listed on recognised stock exchanges. Although still relatively new (with the first Indian REIT, Embassy Office Parks, launched in March 2019), the early success of REIT in India shows the potential it holds and how it can shape the future.

According to CEO Aravind Maiya, Embassy Office Parks REIT is investing over ₹100 crore to develop metro stations in Bengaluru, underscoring its commitment to enhancing the city’s infrastructure. With developers now working closely with international investors, the sector is seeing higher standards in governance and project management. This shift not only benefits overseas investors but is also shaping a more resilient and competitive real estate market in India. It’s an exciting time for anyone considering a stake in India’s dynamic property landscape.

Luxury & High-End Housing

In Q1 2024, luxury homes priced above Rs 1.5 crore accounted for 21% of total sales, highlighting the increasing appeal among affluent buyers. As India’s economy grows and its middle and upper classes expand, more individuals gravitate towards a luxury lifestyle. This shift is reflected in the rise of high-end residential markets, premium retail spaces, and exclusive lifestyle services across the country.

The millennial demographic, which makes up 36% of the population, is driving the demand for luxury properties. According to a recent JLL report, millennials represented 54% of homebuyers last year, with a collective spending power exceeding US$330 billion (approximately ₹27,39,000 crore). This trend is expected to strengthen even further in the coming year.

Modern Spaaces caters to premium living with offerings like Soulace Premium Villas and Ivy County premium plotted development.

Market Growth and Price Trends in Bangalore

-

Property Price Increase :

Bangalore’s real estate market is on an upward trajectory, with average property prices expected to climb from approximately ₹7,500 per square foot in 2024 to around ₹7,900 in 2025. For example, in areas like Sarjapur Road, which enjoys prime connectivity to IT hubs and extensive amenities, property values have seen remarkable growth. Over the past year alone, prices in Sarjapur Road surged by 36.3%. In the latest quarter (July-September 2024), apartment prices hit ₹10,800 per square foot, marking an impressive 11% rise from the previous quarter.

-

Demand Surge :

Bangalore’s reputation as a tech hub continues to draw professionals from across India, sustaining housing demand, especially among millennials and Gen-Z buyers who are now prioritising homeownership over renting.

-

Rental Market Dynamics :

Bangalore’s rental market remains robust, driven by a shortage of ready-to-move-in properties. Many new residents, particularly those working near tech parks, continue to seek rental accommodations close to business hubs.

Conclusion

India’s real estate sector is poised for a dynamic future, with substantial growth projected across various segments. As we head toward 2025, the market is set to benefit from evolving trends, including multigenerational living, green buildings, senior living, and a focus on affordability. Government initiatives and rising foreign investments are enhancing transparency, fueling demand, and expanding the industry’s reach beyond metro cities into Tier II regions. With rising property values, especially in tech hubs like Bangalore, and the increasing appeal of sustainable, connected communities, the real estate landscape in India is evolving to meet the aspirations of diverse homebuyers and investors alike. This transformation is creating a vibrant, resilient market ready to meet the future needs of Indian society.

Read our Latest Blogs

Rise of Women homeowners: Why are they turning towards real estate?

Author: Vinay Gurudutt

- May 13, 2025

- 19 min read

Spotlight on Modern Spaaces

Author: Vinay Gurudutt

- May 13, 2025

- 4 min read

Build Your Dream Home: The Benefits of Plotted Developments

Author: Vinay Gurudutt

- May 13, 2025

- 11 min read

Explore Projects

The True 3 BHK

starts @ 1.55 Cr

Multi-Gen 2 & 3 BHK Homes

Starts @ 1.4 Cr

Pristine Villa Plots

starts @ 1.15 Cr

Refer & Earn Up to 2%

Invite your friends to explore Modern Spaaces and earn up to 5% of the home value they buy.

Find your Dream Home. Let's talk

Tell us a bit about what you're looking for. One of us will get back to you!